Building Autonomous Economic Agents: LangChain Updates and Privy Integration

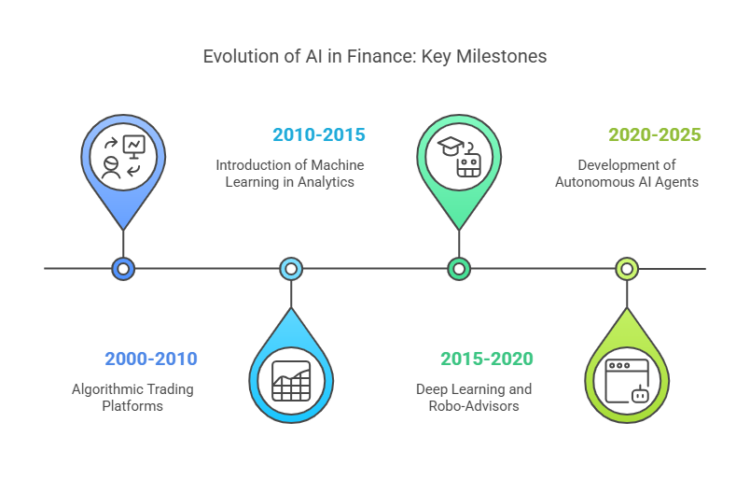

The landscape of Artificial Intelligence is undergoing a seismic shift. We are moving rapidly from the era of “Chat AI”—where Large Language Models (LLMs) passively generate text—into the era of “Agentic AI.” In this new paradigm, AI models act as autonomous agents capable of planning, reasoning, and executing complex workflows. One of the most significant barriers to true autonomy has been the inability of agents to participate in the economy directly. Until recently, an AI could plan a travel itinerary, but it couldn’t book the flight. It could analyze market data, but it couldn’t execute the trade.

Recent updates to the LangChain ecosystem, specifically the integration of server-side wallet infrastructure via providers like Privy, have shattered this ceiling. AI agents can now hold, manage, and transact with stablecoins. This development transforms agents from digital assistants into autonomous economic actors. This article delves deep into the technical implementation of these features, exploring how modern Python tooling—from GIL removal considerations to FastAPI integrations—supports this new architecture.

The Evolution of Agentic Workflows

Before diving into the code, it is essential to understand the architectural changes within LangChain that facilitate these financial capabilities. The shift from legacy `AgentExecutor` to LangGraph represents a move toward stateful, cyclic graph architectures. This is crucial for financial transactions where state management (pending, confirmed, failed) is non-negotiable.

Furthermore, the Python ecosystem supporting these agents is evolving. With the upcoming GIL removal (Global Interpreter Lock) in CPython and the introduction of Free threading, the potential for high-concurrency agent systems is growing. While we wait for full adoption, tools like Uv installer, Rye manager, and Hatch build are making dependency management for these complex AI applications significantly faster and more reliable.

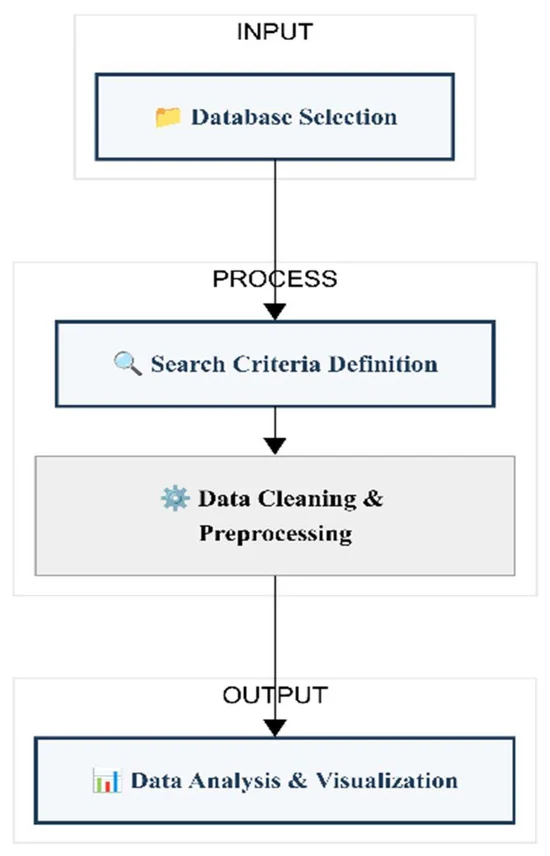

Section 1: Core Concepts and Environment Setup

To build an agent capable of paying with stablecoins, we need to bridge the gap between natural language reasoning and blockchain execution. This requires a robust environment. We recommend using PDM manager or the new Uv installer for lightning-fast setup, ensuring PyPI safety.

The core concept relies on Function Calling (or Tool Calling). The LLM does not sign transactions itself; rather, it outputs a structured JSON object requesting a specific tool execution. LangChain intercepts this request and routes it to a secure wallet provider (Privy).

Setting up the Agent Environment

Below is a setup using modern Python practices, including Type hints and Pydantic for data validation. We will simulate the structure of a wallet tool.

import os

from typing import Optional, Type

from langchain_core.tools import BaseTool

from pydantic import BaseModel, Field

from langchain_openai import ChatOpenAI

from dotenv import load_dotenv

# Load environment variables

load_dotenv()

# Define the input schema for the transaction tool

class StablecoinTransferInput(BaseModel):

recipient_address: str = Field(description="The wallet address of the recipient")

amount: float = Field(description="The amount of USDC/Stablecoin to send")

chain_id: int = Field(default=1, description="The blockchain network ID (e.g., 1 for Mainnet)")

# Define the Custom Tool

class PrivyPaymentTool(BaseTool):

name: str = "send_stablecoin"

description: str = "Useful for sending stablecoin payments to a specific address via Privy wallet."

args_schema: Type[BaseModel] = StablecoinTransferInput

def _run(self, recipient_address: str, amount: float, chain_id: int = 1) -> str:

"""

Synchronous execution of the wallet transaction.

In a real scenario, this connects to the Privy SDK.

"""

# Simulation of Privy Server-Side Wallet Interaction

print(f"Initiating transaction of {amount} USDC to {recipient_address} on chain {chain_id}...")

# Mocking a transaction hash return

tx_hash = f"0x{os.urandom(32).hex()}"

return f"Transaction successful. Hash: {tx_hash}"

async def _arun(self, recipient_address: str, amount: float, chain_id: int = 1) -> str:

"""

Asynchronous execution for high-performance non-blocking calls.

Crucial for integration with FastAPI or Django async.

"""

# Logic for async wallet interaction would go here

return self._run(recipient_address, amount, chain_id)

# Initialize the LLM

llm = ChatOpenAI(model="gpt-4-turbo", temperature=0)

# Bind the tool to the LLM

tools = [PrivyPaymentTool()]

llm_with_tools = llm.bind_tools(tools)

print("Agent environment configured successfully.")In this example, we define a strict schema using Pydantic. This is critical for Python security. You do not want an LLM hallucinating parameters when money is involved. Tools like Ruff linter and Black formatter should be part of your CI/CD pipeline to ensure this code remains clean and compliant.

Section 2: Implementation with LangGraph

While the previous example showed a basic tool definition, modern LangChain updates emphasize the use of LangGraph for orchestration. LangGraph allows us to define cyclical flows, which is vital for agents that need to “check balance,” “insufficient funds,” “request top-up,” and “retry payment.”

This approach is far superior to linear chains. It allows for error handling logic similar to what you might find in Rust Python implementations or Mojo language concepts—prioritizing safety and state management.

from typing import TypedDict, Annotated, Sequence

from langchain_core.messages import BaseMessage, HumanMessage, ToolMessage

from langgraph.graph import StateGraph, END

import operator

# Define the Agent State

class AgentState(TypedDict):

messages: Annotated[Sequence[BaseMessage], operator.add]

wallet_balance: float

# Define the Agent Node

def call_model(state):

messages = state['messages']

response = llm_with_tools.invoke(messages)

return {"messages": [response]}

# Define the Tool Execution Node

def call_tool(state):

messages = state['messages']

last_message = messages[-1]

# Construct the tool mapping

tool_map = {tool.name: tool for tool in tools}

tool_outputs = []

for tool_call in last_message.tool_calls:

tool = tool_map[tool_call["name"]]

print(f"Executing tool: {tool.name}")

try:

tool_output = tool.invoke(tool_call["args"])

except Exception as e:

tool_output = f"Error executing transaction: {str(e)}"

tool_outputs.append(

ToolMessage(

content=str(tool_output),

tool_call_id=tool_call["id"]

)

)

return {"messages": tool_outputs}

# Conditional Logic for Routing

def should_continue(state):

messages = state['messages']

last_message = messages[-1]

if last_message.tool_calls:

return "continue"

return "end"

# Build the Graph

workflow = StateGraph(AgentState)

workflow.add_node("agent", call_model)

workflow.add_node("action", call_tool)

workflow.set_entry_point("agent")

workflow.add_conditional_edges(

"agent",

should_continue,

{

"continue": "action",

"end": END

}

)

workflow.add_edge("action", "agent")

app = workflow.compile()

# Execute the Agent

inputs = {"messages": [HumanMessage(content="Send 50 USDC to 0x123abc... for the service fee.")]}

# Note: In a real app, use async invocation

for output in app.stream(inputs):

for key, value in output.items():

print(f"Finished running: {key}")This structure allows the agent to reason about the output of the payment. If the PrivyPaymentTool returns an error (e.g., “Insufficient funds”), the agent receives that as a ToolMessage and can generate a natural language response explaining the failure to the user, rather than crashing.

Section 3: Advanced Techniques and Data Integration

Financial agents rarely work in isolation. They often need to analyze data before making a payment decision. This is where the broader Python data ecosystem comes into play. Integrating Pandas updates, Polars dataframe, or DuckDB python allows agents to process transaction history or market data efficiently before executing a trade.

For example, an agent might need to verify that a service was performed before releasing payment. This could involve using Playwright python or Selenium news-related updates to scrape a verification portal, or checking an API using Litestar framework or FastAPI.

Verifying Data Before Payment

Let’s create a composite system where an agent checks a dataset using Polars (for speed) to verify a vendor’s reputation before allowing the Privy wallet to sign the transaction.

import polars as pl

class VendorVerificationTool(BaseTool):

name: str = "verify_vendor"

description: str = "Checks if a vendor address is whitelisted using local data."

def _run(self, vendor_address: str) -> str:

# Create a dummy DataFrame (simulating a large dataset)

# Polars is preferred over Pandas here for performance in data-heavy apps

df = pl.DataFrame({

"address": ["0x123abc...", "0xdef456...", "0x789ghi..."],

"reputation_score": [98, 45, 88],

"is_verified": [True, False, True]

})

# Query the dataframe

vendor = df.filter(pl.col("address") == vendor_address)

if vendor.height == 0:

return "Vendor not found in database. High risk."

score = vendor["reputation_score"][0]

verified = vendor["is_verified"][0]

if verified and score > 80:

return "Vendor is verified and has high reputation. Proceed."

else:

return f"Vendor verification failed. Score: {score}, Verified: {verified}"

# Add this to the tools list

tools = [PrivyPaymentTool(), VendorVerificationTool()]

# Re-bind tools to LLM...By combining logic tools with action tools, we create a safer agent. This touches on LlamaIndex news as well, as you could replace the Polars lookup with a RAG (Retrieval-Augmented Generation) query over a vector database containing vendor contracts.

Section 4: Best Practices, Security, and Optimization

When dealing with Local LLM deployments or cloud-based agents handling funds, security is paramount. The integration of LangChain updates with financial tools introduces new attack vectors. Here are critical best practices:

1. Human-in-the-Loop (HITL)

Never allow an agent to sign a transaction without a final approval step for amounts over a certain threshold. LangGraph makes this easy by adding an “interrupt” before the execution node. This ensures Python security standards are met in logic flow.

2. Defensive Coding and Testing

Use Pytest plugins to mock your wallet interactions during development. You should never run your test suite against a live mainnet wallet. Furthermore, employ static analysis tools like SonarLint python and MyPy updates to catch type errors that could lead to financial loss.

3. Asynchronous Optimization

Blockchain transactions are slow. Blocking the main thread while waiting for a transaction hash is inefficient. Utilize Django async or FastAPI with Python’s `asyncio` to handle these requests. Below is a snippet demonstrating how to handle timeouts gracefully.

import asyncio

async def safe_transaction_execute(tool, args, timeout=30):

"""

Wrapper to execute transaction tools with a timeout.

Prevents the agent from hanging indefinitely.

"""

try:

# Wait for the tool execution with a timeout

result = await asyncio.wait_for(tool.arun(**args), timeout=timeout)

return result

except asyncio.TimeoutError:

return "Transaction timed out. Network may be congested. Please check status manually."

except Exception as e:

# Log this error for Malware analysis / Security auditing

print(f"CRITICAL ERROR: {e}")

return "Transaction failed due to internal error."This approach is essential for Algo trading bots or Python finance applications where timing is critical. Additionally, keeping an eye on MicroPython updates and CircuitPython news is interesting for Edge AI applications, where agents on hardware devices (like Point of Sale systems) might trigger these payments.

Conclusion

The integration of Privy’s stablecoin payment infrastructure into LangChain agents marks a pivotal moment in AI development. We are witnessing the convergence of Python automation, blockchain finance, and advanced reasoning capabilities. By leveraging modern tools like LangGraph, Polars, and robust testing frameworks like Pytest, developers can build agents that are not only intelligent but also economically empowered.

As we look forward, developments in Python quantum computing (via Qiskit news) and further optimizations in PyTorch news and Keras updates will likely make these agents faster and smarter. However, the immediate opportunity lies in using the tools available today to build secure, autonomous agents that can interact with the real world through financial transactions. Whether you are building with Reflex app, Flet ui, or PyScript web interfaces, the backend logic for economic agents is now ready for production.